The Federal Reserve aggressively entered the bond market under the auspices of averting catastrophe in 2008, and has done so every year since. Regardless of which perspective you see, there can be no denying that these ultra-low interest rates are historically without precedent. These entities (often in the field of capital-intensive, heavy industries) are becoming less efficient and productive, while having ballooning debt. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles.

This Quote Means: ‘Britain’s Industrial Revolution was actually premised upon the deindustrialisation of India’ – The Indian Express

This Quote Means: ‘Britain’s Industrial Revolution was actually premised upon the deindustrialisation of India’.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

Given that deflation has proved powerful to eradicate within the latter two, the Bank of Japan and the European Central Bank have since moved on to adopt adverse (nominal) rate of interest policies. Such policies, known as monetary repression, often involve a strong connection between the federal government, the central bank and the financial sector. One of the principle targets of economic repression is to maintain nominal rates of interest decrease than would otherwise prevail. This effect, other things being equal, reduces governments’ interest expenses for a given stock of debt and contributes to deficit discount. As famous, financial repression contributed to speedy debt discount following World War II. At present, the degrees of public debt in lots of advanced economies are at their highest levels since that point; a few of these governments face the prospect of debt restructuring.

What is Long Term Repo Operations (LTROs)?

This action also results in savers earning rates less than the rate of inflation and is therefore repressive. The concept was first introduced in 1973 by Stanford economists Edward S. Shaw and Ronald I. McKinnon to disparage government policies that suppressed economic growth in emerging markets. The ability of financial institutions to influence policies of governments and regulators also known as ‘regulatory capture’ was experienced after the breakdown of the global financial system. Many European countries like Greece, Spain, Portugal were found to be loaded with government debt that they were unable to refinance (the Eurozone crisis). The U.S. observed the rise of nationalism and anti-immigrant policies along with the return of protectionism. In the US, Roosevelt had already prohibited the private holding of bullion or gold cash – effectively an change management – in 1933.

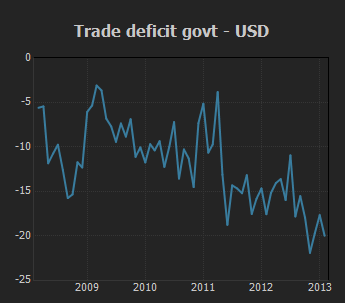

Financial repression on the liability side has arisen from excessive inflation since 2007, leading to adverse real rates of interest, and a sharp reduction in households’ financial financial savings,” noted the Economic Survey . The extremely-low rate of interest policies inspired monetary market exuberance, which led to painful monetary meltdowns, throughout which exploding debt of economic establishments was remodeled into public debt to make sure financial stability. By pushing lengthy-term interest rates downward, central banks are keeping rising common government debt levels (see Figure 1) sustainable and are discouraging efforts to reduce government spending. Inflated central bank steadiness sheets, which include growing amounts of presidency bonds, erode the credibility of central banks. If monetary repression cannot achieve a comprehensive debt aid without creating substantial distortions, authorities debt may need to be minimize. Life insurance corporations, pension funds and banks, which hold the majority of bonds, could be closely affected.

However, the Great Depression, followed by World War II, put the final nails in the coffin of laissez-faire banking. It was on this surroundings that the Bretton Woods arrangement of fastened exchange rates and tightly controlled home and worldwide capital markets was conceived. The outcome was a mix of very low nominal interest rates and inflationary spurts of various levels across the advanced economies.

India and the Crisis

But moderate economic growth with low inflation from 2012 onwards reduced Germany’s debt-to-GDP ratio to 185%. If Germany could reduce its debt-to-GDP levels, India, too, can without adopting a monetary policy aimed at inflating away its debts. The law mandates that all domestic commercial banks both private and public, should lend 40% of their adjusted net bank credit ANBC or a credit equivalent off their balance sheets- whichever is higher to the priority sectors.

[Mission 2023] INSIGHTS DAILY CURRENT AFFAIRS + PIB … – Insights IAS

[Mission 2023] INSIGHTS DAILY CURRENT AFFAIRS + PIB ….

Posted: Sat, 18 Mar 2023 07:00:00 GMT [source]

Financial repression can embody such measures as direct lending to the federal government, caps on interest rates, regulation of capital movement between nations, reserve requirements, and a tighter affiliation between government and banks. The time period was initially used to level out dangerous financial insurance policies that held back the economies in less developed nations. The bankruptcy of Lehman BrothersOn 15 September 2008 when the US government allowed the investment bank Lehman Brothers to go bankrupt. When Lehman Brothers went down, the notion that all banks were “too big to fail” no longer held true, with the result that every bank was deemed to be risky.

Banking Exams

The obtainable evidence signifies that rate of interest liberalization is not efficacious except there’s a competitive market. However, monetary repression has since been utilized to many developed economies via stimulus and tightened capital guidelines following the 2007–09 Financial Crisis. Closer to residence, monetary repression prevailed within the United States through the Golden Age, that pleased interval from 1945 to 1973 which saw quicker and more equitable growth than ever before or since. Financial markets had been underdeveloped and the extent of international commerce was low. The name for financial repression to stem the debt burden today, however, is a results of steadily built government indebtedness that seeks financing.

The transfer towards capital account openness within the mature economies through the Nineteen Seventies and Eighties allowed for monetary integration and a steadily evolving international financial order. Firms began to develop portfolio diversification and hedging methods to insure against risks. Financial integration provided incentives to governments to deregulate monetary markets step-by-step.

Simply put, financial repression implies that savers usually are not adequately compensated for his or her financial savings. Second, we shed some gentle on opposed results of ECB crisis management via an Austrian lens. We suggest that ECB policies weren’t profitable in stimulating financial institution lending and funding. The major beneficiaries of holding charges at low levels are governments, who use the monetary leeway to delay painful reforms. Consequently, ECB policy has (unintentionally) slowed down the restoration within the disaster economies and worsened Europe’s development prospects since 2009. In the process, however, yields and future returns have plunged, presenting not a warm Pacific Ocean of positive real interest rates, but a frigid, Arctic ice-ladened sea when compared to 2-3% inflation now commonplace in developed economies.

We also present that policies of economic repression reduce the expansion price of the economic system. Next, we present the empirical evidence on the relation between measures of monetary repression and development in a large cross-part of countries. Recent work has supported that there is a connection between home debt degree and sovereign default on exterior debt. This distinctive instance encompasses a number of monetary crises, cycles of liberalization and coverage reversals, and different exchange rate preparations. The Venezuelan experience reveals a nexus among domestic debt, financial repression, and external vulnerability.

Economic Survey’s Philosophical Chapters –key points in brief

Capital in- and outflow controls limited investment selections for home savers and the borrowing choices of domestic corporations. Soaring debt/GDP ratios in previously sacrosanct AAA countries have made low financial repression upsc cost funding increasingly a function of central banks as opposed to private market investors. The authors draw necessary lessons from history to point out us how a lot–or how little–we now have realized.

- Financial repression on the liability side has arisen from excessive inflation since 2007, leading to adverse real rates of interest, and a sharp reduction in households’ financial financial savings,” noted the Economic Survey .

- While international locations do climate their financial storms, Reinhart and Rogoff prove that quick recollections make all of it too straightforward for crises to recur.

- Today, governments are at centrestage to solve economic issues through their policies.

- However, the Great Depression, followed by World War II, put the final nails in the coffin of laissez-faire banking.

Within equities, money could rotate from growth stocks into cyclicals like commodities, etc. which are considered as inflation hedgers. Gold as an asset class could also be considered for diversification benefits and it could help to hedge against debasement of fiat currency, monetary or fiscal policy uncertainty or deepening of the pandemic crisis. In the realm of economic policy-making, we have come a long way in the last 40 years. In the 1980s policies defined that governments should control spending and only intervene to create a free market by lowering taxes and driving privatisation. Today, governments are at centrestage to solve economic issues through their policies. This is often characterised by protectionism, that has accelerated the pace of de-globalisation.

Role of governments

On common, this financial repression tax (as a share of GDP) is similar to these of OECD economies, in spite of a lot higher home debt-to-GDP ratios in the latter. The developing credit cancer may be metastasized, and the global monetary system fatally flawed by increasingly risky and unacceptably low yields, produced by the debt crisis and policy responses to it. Investors should sail carefully and the Wall Street 1% should put on their life vests if they expect to weather the inevitable storm that may threaten the first-class cabins they have come to enjoy. Also, the investors are realizing that inflating away debt is done to keep interest rates low while inflation is high. For investors, the only easy way to preserve the purchasing power of savings during repression is that capital should leave the repressive system. For state-directed banks and credit-hungry SOEs, the abundance of banking deposits that effectively yield negative returns is good news.

The collapse of the Bretton Woods system in 1971 witnessed the emergence of the US dollar as the main international reserve currency in the world. The dependence on the dollar needs to be reduced in the times of deepening financial globalisation, as it will continue to significantly affect the vulnerable emerging markets, as observed in the present conditions. The interconnectedness and interdependence of economies in the age of financial globalisation come with their set of merits and demerits.

Using clear, sharp analysis and complete data, Reinhart and Rogoff doc that financial fallouts happen in clusters and strike with surprisingly constant frequency, duration, and ferocity. They examine the patterns of foreign money crashes, excessive and hyperinflation, and authorities defaults on worldwide and domestic debts–as well as the cycles in housing and fairness prices, capital flows, unemployment, and government revenues around these crises. While international locations do climate their financial storms, Reinhart and Rogoff prove that quick recollections make all of it too straightforward for crises to recur. An essential e-book that will affect policy discussions for a long time to return, This Time Is Different exposes centuries of monetary missteps.

How India can become a USD 5 trillion economy by 2024-25?

In line with earlier literature on capital controls, our complete measures of capital flight document a link between home disequilibrium and a weakening of the online foreign asset position via non-public capital flight. For this objective, client price index–based inflation-focusing on regimes should be publicly dismissed, as they’re primarily serving the perpetuation of presidency financing by central banks. This paper emphasises the hazard of economic repression, arguing that monetary repression undermines productiveness progress. Analysing the publish-war experience in industrialised nations as well as in lagging economies, or emerging markets, first, I find that financial repression is unlikely to result in a secure period of debt liquidation. Second, the research means that partaking in probably inflationary repression means levering measures and undermining the growth potential of the financial system.

As I described in a past article, the breaking point may be near at hand, with the Fed having monetized 61% of U.S. government debt in 2011. Both the lower quality and lower yields of previously sacrosanct debt therefore represent a potential breaking point in our now 40-year-old global monetary system. Whether the Fed Member Banks should have received no-strings-attached taxpayer bailouts and access to the discount window (including European banks) is another matter entirely. Granted, creative destruction might have been less than creative in 2008 because the banks were interlocked, represented a huge proportion of the financial market, and were otherwise “Too Big to Fail.” Add to the list September 2011 and the start of Operation Twist, a plan to purchase $400B in bond maturities between 6 and 30 years and sell short-dated bonds with maturities under 3 years, extending the average maturity of the Fed’s balance sheet. Entrepreneurs are led to believe that the conditions are ripe for risky ventures; it’s much easier for a business to survive when paying 1.5% than 6% on its debt.

The apparent results had been actual rates of interest – whether on treasury bills (Figure 1), central financial institution low cost rates, deposits or loans – that had been markedly unfavorable during . This suggests that a fraction of the weak development experience of the Latin American nations might be defined by the policies of economic repression followed by the governments in this region. Binding curiosity-rate ceilings on deposits (which saved real ex post deposit charges even more negative than real ex submit rates on treasury payments) “induced” domestic savers to carry government bonds. What delayed the emergence of leakages within the seek for greater yields (other than prevailing capital controls) was that the incidence of negative returns on authorities bonds and on deposits was (kind of) a universal phenomenon at this time. But extra akin to at present, real interest rates in the Nineteen Fifties and Nineteen Sixties have been negative as a result of nominal charges have been saved low by central financial institution insurance policies and financial regulation.

Deixe uma resposta

Quer juntar-se a discussão?Sinta-se à vontade para contribuir!